Savings

Understanding Regular Deposits

Any savings account consist of five important numbers. These are the following:

(1) The final lump sum you will receive at the end (often called the future value).

(2) The total amount you want to invest every month.

(3) The interest rate which you will receive on your deposits.

(4) The number of years the money will be in the bank for.

(5) The number of years it will take for you to have saved a certain amount.

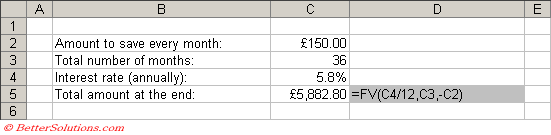

Lets assume you want to save £150 a month for 3 years in an account that offers 5.8% interest a year.

How much would I have saved at the end ?

FV - The future value of an investment over a period of time.

FV(rate, nper, pmt [,pv] [,type])

|

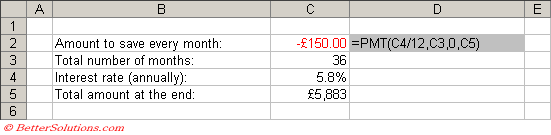

How much do I need to save a month ?

PMT - The payment for a loan with constant payments and fixed interest.

PMT(rate, nper, pv [,fv] [,type])

|

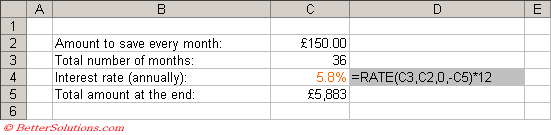

What interest rate am I getting ?

RATE - The interest rate per period of an annuity.

RATE(nper, pmt, pv [,fv] [,type] [,guess])

|

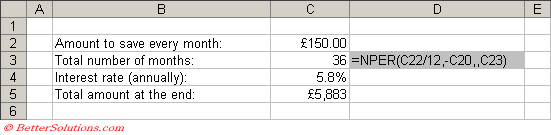

How many months have I been saving for ?

NPER - The number of periods for an investment.

NPER(rate, pmt, pv [,fv] [,type])

|

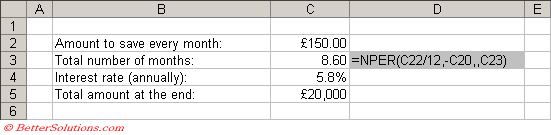

How many years until I have £20,000

NPER - The number of periods for an investment.

NPER(rate, pmt, pv [,fv] [,type])

|

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext