Par Curve

Also called Full Coupon Yield Curve, par yield curve, par curve,

When a bond is priced at par, the yield to maturity is equal to the coupon rate.

This type of curve is only used in the primary market when new bonds are being issued.

Only really used in the primary market to set the coupons for new issues.

This curve is a graph of theoretical securities with prices at par.

The par yield is the coupon rate that causes the bond price to equal its face value.

The par yield is equal to the coupon rate for bonds priced at par.

On the run treasury bonds trade very close to par.

If the spot curve is upward slowing the par curve is below the spot curve

If the spot curve is downward slowing the par curve is above the spot curve

Creating

A par curve is a constructed curve where each point represents the yield on a coupon paying treasury priced at par.

This yield curve is constructed by plotting the yield to maturity against the term to maturity for bonds trading at (or near) par.

This curve can be derived directly from bonds in the market that are trading at (or near) par

If bonds are not trading at (or near) par then the yield curve will be distorted

This gives a better indication/measure of where current rates are at a particular maturity.

The par yield curve plots yield to maturity against terms to maturity for current bonds trading at par.

Creating - Using the Zero Coupon Curve

When bonds are not trading at (or near) par this curve can be derived by iteration using the spot yield curve.

When bonds are trading away from par, the par yield curve will be distorted.

Coupon Calculation for New Issues

For those involved in the primary market this type of yield curve is used to determine the required coupon when a new bond is issued at par.

Consider that par yields on 1 year, 2 year and 3 year bonds are 5%, 5.25% and 5.75% respectively.

This implies that a new 2 year bond would require a coupon of 5.25% if it was ussued at par.

Example

The par yield is the coupon rate that causes the bond price to equal its face value.

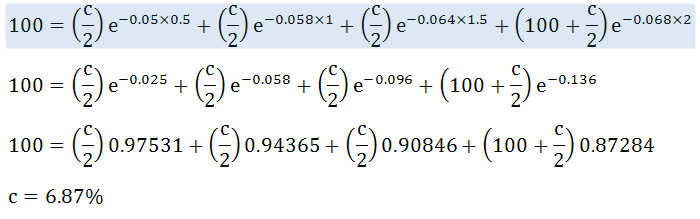

Lets assume we have the following treasury zero rates:

6 months - 5%

12 months - 5.8%

18 months - 6.4%

24 months - 6.8%

What is the par yield of a 2 year bond with principal of $100 that pays a semi-annual coupon

Lets assume that "c" is the coupon paid annually (ie the par yield)

|

The par yield is 6.87% per annum with semi-annual coupounding

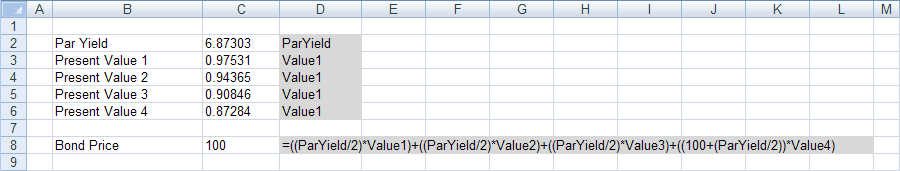

This can be calculated using the Goal Seek functionality

|

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext