Call Option

A call option is the right to buy an asset for an agreed price on or before a certain with no obligation.

If you are the holder of a call option you want the stock to rise as much as possible.

The higher the stock price the more profit you will make.

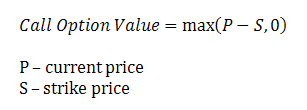

When would you exercise a call option ?

You would exercise a call option at expiry if the current price is above the strike price.

This means you can sell the stock in the market for more than you are buying it for.

This function of the value of a call option is called a payoff function and can be plotted on a Payoff Diagram.

The max function is used to indicate there is no obligation.

|

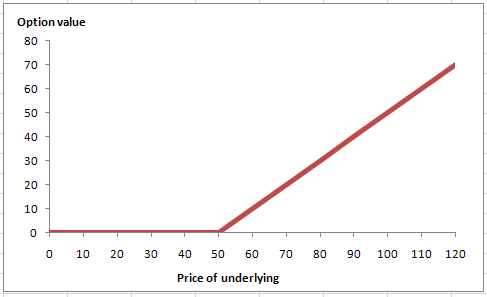

Payoff Diagram

This is a simple payoff diagram for buying a european call option with a strike price of 50 at expiry:

|

Profit Diagram

A profit diagram can be helpful as it indicates how far into the money the underlying must be before the option becomes profitable.

In plot an accurate profit diagram you need to take the premium into account.

SS

Bloomberg Option Valuation Screen

MSFT

Source: Bloomberg L.P

Bloomberg Scenario Analysis Screen

Source: Bloomberg L.P

The reason this profit diagram is slightly curved is due to the time value of money.

Value everything today - You should either discount the payoff by multiplying by e -r(T-t)

Value everything at expiry - You should ?? The premium by multiplying by e r(T-t)

© 2026 Better Solutions Limited. All Rights Reserved. © 2026 Better Solutions Limited TopPrevNext