Different Types

International Bonds

International Bonds = eurobonds (they are the same thing)

The terms Euromarkets and Eurobonds are well established but referred to them as International markets and international bonds is more accurate.

Domestic Bonds

UK company raise £ on the UK debt market

Bonds in the US domestic market usually pay semi-annual coupons.

Foriegn Bonds

These are domestic "issues by non residents"

Bulldogs in the UK

Yankees in the US

Samurai in Tokyo

Notice that the bonds are domestic bonds in the local currency, its only the issuer who is foreign.

They should not be confused with international bonds (or eurobonds) which are bonds issued outside thair natural market.

Junk Bonds - bonds rated below BBB as a result they offer much higher interest

Global Bonds - Designed to be sold in the eurobond market and the US at the same time, thus increasing liquidity. The two markets have different conventions.

Eurobonds are bearer, pay interest gorss and annually

US bonds are registered, pay interest net and emi-annually.

Dragon Bonds - A dragon bond is listed in Asia (typically Hong Kong or Singapore)

MTN - Medium Term Notes

These were designed to meet investors driven transactions. An investor might request, say $10m more of a previously issued bond and the issuer will release more to meet this demand. The issuer can thus issue a new bond, more of an existing bond, or create a new bond to a specification suggested by the investor.

The rate of interest is the price of money

It varies with risk, maturity and liquidity

Bonds have a par or nominal value. They may sell at below or above par value and the resulting returns to the investor is called the yield

If we ignore the profit or loss at redemption, this is the interest yield.

If we take the profit and loss at redemption into account then it is the gross redemption yield.

If the bond is sold before going ex-dividend, the buyer pays the accrued interest.

Foreign Bonds

Issued by a borrower in a domestic capital market other than its own, usually denominated in the currency of that market underwritten and sold by a national country.

| Bulldog Bonds | |

| Samurai Bonds | |

| Yankee bonds - dollar bonds issued in the US by non residents | |

| Shogun Bonds | |

| Shibosai Bonds | |

| Matador Bonds | |

| Daimyo Bonds |

UK company raises $ on the US debt market

Local authority and public sector issues are very rare in the UK, although some long dated bonds were issued in the 1970s are still in issue.

Bearer Bonds

These are bonds that belong to whoever holds them.

There is no official register of who owns them

They are traded without any record of ownership and have coupons that must be clipped and sent to the issuer in order to receive the scheduled payments.

Registered Bonds

These bonds belong to the registered holder

The issuer keeps a record of ownership and automatically sends the scheduled payments.

Dragon Bonds

A Eurobond issued in Hong Kong or Singapore and targeted for primary distribution to Asian investors.

Brady Bonds

Bowie Bonds

Bullet Bonds

These are ordinary annuities.

Dual Currency Bonds

A hybrid debt instrument with payment obligations over the life of the issue in two different currencies

The borrower makes coupon payments in one currency but redeems the principal at maturity in another currency in an amount fixed at the time of the issue of the bonds.

Bonds where coupon payments can be made in one currency and principal payment made in another.

sometimes a good option for multi-nationals

Drop-Lock Bonds

Combines the features of both a floating and fixed rate security

The drop-lock bond is issued with a floating rate interest which is reset semi-annually at a specified margin above a base rate (such as 6-month LIBOR)

This continues until such time as the base rate is at or below a specified trigger rate on an interest fixing date or in some cases, on two consecutive interest fixing dates.

At that time the interest rate becomes fixed at a specified rate for the remaining lifetime of the bond.

Subordinated Bonds

Subordinated bonds are those that have a lower priority than other bonds of the issuer in case of liquidation.

You can get subordinated secured and unsecured bonds.

In case of bankruptcy, there is a hierarchy of creditors.

First the liquidator is paid, then government taxes, etc.

The first bond holders in line to be paid are those holding what is called senior bonds.

After they have been paid, the subordinated bond holders are paid. As a result, the risk is higher.

Therefore, subordinated bonds usually have a lower credit rating than senior bonds.

The main examples of subordinated bonds can be found in bonds issued by banks, and asset-backed securities.

The latter are often issued in tranches.

The senior tranches get paid back first, the subordinated tranches later.

Hybrid

Combines the characterstics of 2 or more instruments (often debt and equity)

certain classes of preferred stock are classified as hybrid

other examples include:

1) convertible bonds - a variation of a convertible bond that enables bondholders to exchange their bonds for common stock of a company other than that of the issuer.

benfits for an issuer depend on its equity-like or debt-like features

debt-equity continuum - allows institutions to classify part of a hybrid security as equity and part as debt.

most popular (75% equity, 25% debt) = basket D

A hybrid security is generally subordinated debt.

A hybrid security is generally the most junior debt ranking issue of a company

Subordinated to all other debt.

Perpetual Bonds

Some stocks have no redemption date and are called "Undated" or "perpetual"

Also known as a perpetual or just a perp is a bond with no maturity date.

It may be treated as an equity not as a debt instrument.

These types of bonds pay coupons indefinitley and the issuer doesn't have to redeem them.

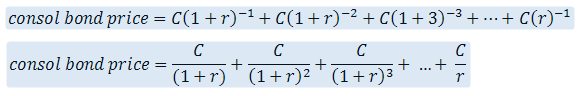

Their cash flows are therefore those of perpetuity

Examples of perpetual bonds are Consols issued by the UK government

Most perpetual bonds issued nowadays are deeply subordinated bonds issued by banks and most of these are callable.

These are bonds that make interest payments for ever but never return the principal

Formally a consol is a perpetuity

They never mature and therefore have an infinite life

Perpetual bonds that have no maturity date.

Also often called perpetuities

|

Important

A Eurobond is an international bond that is denominated in a currency not native to the country where it is issued.

Bear bond is a bond issued in Russian roubles by a Russian entity in the Russian market.

War bond is a bond issued by a country to fund a war.

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext