Yield

When people talk of the Bond Yield they are referring to the Yield To Maturity.

The yield to maturity is the total return you would get on a bond if it was held to maturity.

Yield is the single interest rate which equates the price of a security to the sum of the present values of its cash flows.

This is the interest rate that discounts all future cash flows to the market price

This yield can be used to compare bonds of different maturities and is the yield that is quoted in all the newspapers.

There are three different types:

Basic Current Yield - Only takes into account the coupon. Useless for Zero coupon bonds.

Approximation Yield -

Yield To Maturity - Takes into account compounding interest, but assumes all coupon payments are reinvested at the same rate.

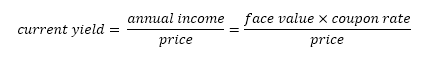

Basic Current Yield

Also known as Running Yield, Flat Yield, Income Yield

This only considers the income portion of the bond return, so it is useful to investors who need current income.

This does not take into account any gains or losses if the bond was purchased at a discount or a premium.

This does not take into account the affect of compounding interest.

Calculated by dividing the annual income (ie the total value of the coupons paid in one year) by its current price.

|

There is no Excel function to calculate the flat yield.

This is very quick, rough and ready calculation.

If the price of a bond paying a 4% coupon is £100, then the flat yield is 4/100 = 4%

If the price of a bond paying a 4% coupon is £95 (trading at a discount), then the flat yield is 4/95 = 4.21%

If the price of a bond paying a 4% coupon is £105 (trading at a premium), then the flat yield is 4/105 = 3.80%

If the price of a $1,000 par value, 5% coupon is selling for $800 then the flat yield is: (1000*5%)/800

Approximation Yield

This is a better approximation that the current yield.

This does not take into account the affect of compounding interest.

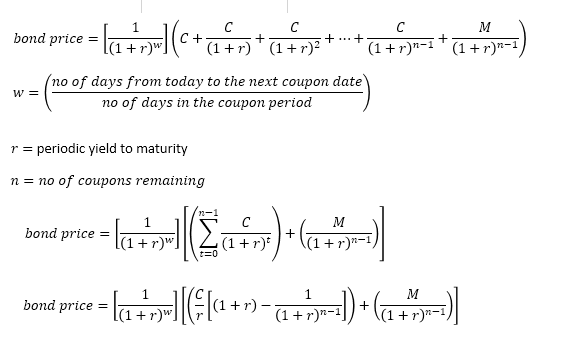

Yield to Maturity

Also known as Redemption Yield, Gross Redemption Yield, True Yield, Internal Rate of Return

This takes into account all the interest payments plus any gain/loss in capital at maturity (ie the difference between the principal value and the current price)

This is the annual discount rate 'r' that can be applied to the cashflows to give you the current price.

The following equation needs to be solved for 'r'.

|

Coupon Yield

Also known as Principal Yield, Par Yield, Nominal Yield, Coupon rate.

Calculated by dividing the annual income (ie the total value of the coupons paid in one year) by its principal.

If a bond has a principal of $1,000 and an annual income of $50, then the coupon yield is 50/1000 = 5%

The 'par yield' = 'coupon' is the rate applied to the cashflows to give the face value.

The par yield is the coupon rate which causes the bond to be priced at par.

Yield Measures

NEM (Net Effective Margin)

Units are in basis points

Often used for adjustable rate mortgage backed securities (ARMS)

DM (Discount Margin)

Often used for floating rate instruments

units are in basis points

not usually converted to semi-annual bond equivalent basis

SS - equation

Important

The lowest yield is typically -1 or -100%.

Price and Yield are inversely related. If the bond price goes up then the bond yield goes down.

It is possible to calculate the yield when you know the price.

The yield is inversely related to the price. Bond prices fall yield goes up. Interest rates down, bond price up.

(gross meaning ignoring tax)

Usually the longer the time to maturity the higher the yield.

The yield to maturity can also be thought of as the Internal Rate of Return (IRR) for the bond.

The yield for example of US Treasuries is an indicator for interest rates and inflation.

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext