Cash Borrowing

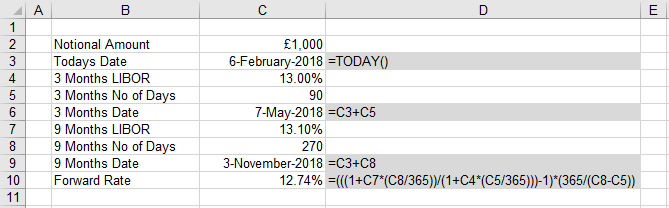

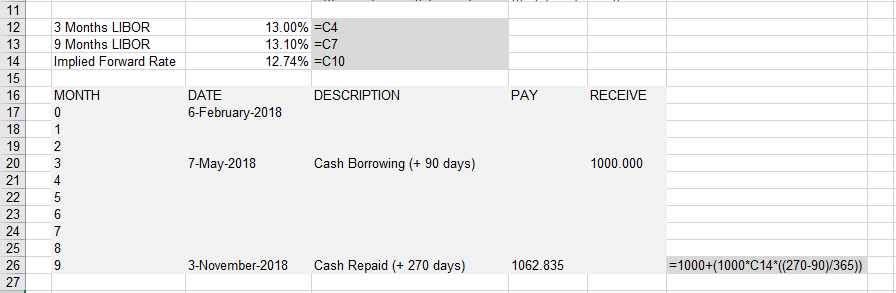

Richard wants to borrow £1,000 for 6 months starting in 3 months time.

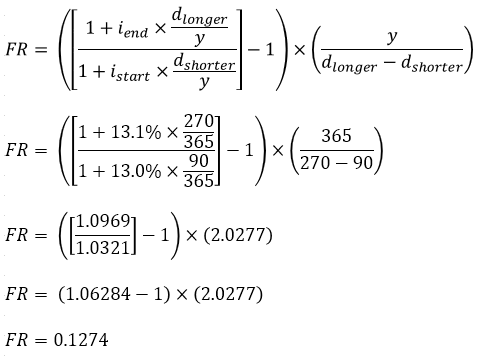

The GBP 3 month forward interest is 13.0%.

The GBP 9 month forward interest is 13.1%.

The forward rate would be 12.74%.

|

|

|

Both Richard and the Bank are exposed to interest rate risk.

Interest Rates go Up

If interest rates go up before the start date then Richard will be better off.

If interest rates go up before the start date then the bank will be worse off.

|

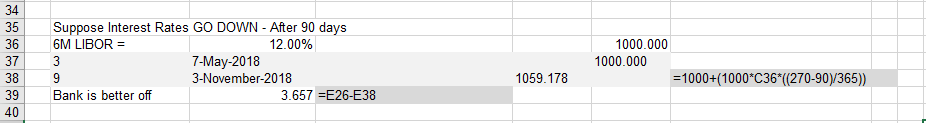

Interest Rates go Down

If interest rates go down before the start date then the bank will be better off.

If interest rates go down before the start date then Richard will be worse off.

|

Hedging the Interest Rate Risk

If the bank wanted to hedge this interest rate risk then it could buy a Forward Rate Agreement.

Example

Jennifer goes to a bank and agrees to borrow £10,000 for 6 months starting in 3 months time.

She agrees to pay back £10,900 in nine months time.

The forward rate would be ( (10900 / 10000) - 1 ) = 9%

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext