Present Value

If we have an amount of money that we are receiving in the future what is this worth today.

The equivalent amount of money today is called the present value.

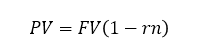

Simple Interest

Simple interest is when interest is not re-invested.

This is an example of an Arithmetic Sequence where a series of numbers differs by a fixed amount.

|

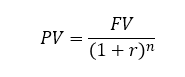

Compounded Interest

Compounded interest is when interest is immediately re-invested.

This is an example of a Geometric Sequence where a series of numbers are multipled by a fixed amount.

|

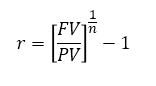

Discount Rate

This is the interest rate 'r' from the Discount Factor equation.

|

The interest rate used to derive the present value of future cash flows is called the discount rate.

Discount rates are used in some markets to price and value short term discount securities.

The higher the discount rate the lower the present value of the future cash flows.

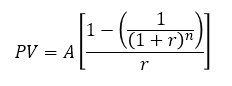

Annuity

This is an example of a Geometric Sequence where a series of numbers are multipled by a fixed amount (or common ratio).

|

Continuously Compounded

Important

The present value of several future cash flows is the sum of the individual present values.

Calculating the present value from a future value is known as discounting.

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext