Discount Rate (Present Value)

The Internal Rate of Return is the interest rate (also known as the Discount Rate) that makes the Net Present Value zero.

There are several problems

1) assumptions made about the reinvested rate

2) it can produce multiple results, every time your cash flows change from positive to negative or negative to positive another solution is added.

reinvestment rate ?

Before we dive into this function it is important to understand the NPV function first

The best way to determine if the IRR can be used is to plot the NPV against the discount rate of return.

If it crosses the x-axis more than once then there are multiple IRRs.

US Treasury Bills and corporate commerical paper are quoted and traded on a discount basis.

This means that there is no explicit coupon payment.

The difference between the face value at maturity and the current price is the implicit interest payment.

The discount rate understates the true yield.

Question

You have been offered one of the following two options, which one would you choose

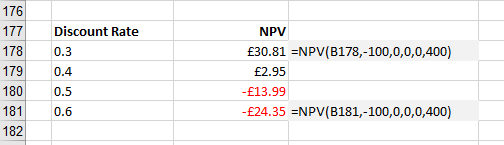

a) invest £100 today and get £400 back in 4 years time

b) invest £100 today and get £500 back in 6 years time

One way you can compare these two amounts is to calculate the discount rate that gives a NPV of zero.

|

We can use a process of iteration for example the Goal Seek functionality in Excel to calculate this discount rate.

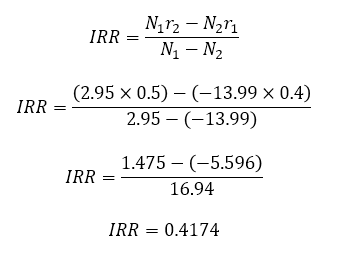

Using linear interpolation we can calculate the internal rate of return.

|

You can use the IRR function to answer this question.

This can be calculated by a process of iteration (or trial and error)

=IRR({-100,0,0,0,400}) = 41.42%

=IRR({-100,0,0,0,0,0,500}) = 30.77%

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext