Forward Rate Agreements

Also known as an Interest Rate Forward

A forward rate agreement (FRA) is an agreement to pay (or receive) on a future date the difference between an agreed interest rate (FRA rate) and the actual interest rate on that future date (on an agreed notional amount).

This is an agreement to exchange a fixed interest rate payment for a floating interest rate payment

Most FRA contracts are linked to LIBOR or Euribor

Buying LIBOR - Long LIBOR

Selling LIBOR - Short LIBOR

A forward rate agreement (FRA) is a forward contract in which one party pays a fixed interest rate, and receives a floating interest rate equal to a reference rate (the underlying rate)

These are Over The Counter

No principal amount is transferred - only margin

This is an off the balance sheet instrument

There is no exchange of principal

An FRA is settled in advanced

Unlike a forward-forward this is paid at the start of the borrowing (or depositing)

This is a single currency

FRA Forward Rate Agreements are a way of fixing a rate of interest for a date in the future and for a given period of time (forward / forward)

The reference rate is fixed one or two days before the effective date, dependent on the market convention for the particular currency

3v9

Accept a forward rate now for an agreement to borrow a notional amount for 6 months starting in 3 months time.

In 3 months time we calculate the present value of this notional amount using the 6 month LIBOR rate and settle the difference

0R6

0R12

The buyer in the case of the FRA is usually called the "payer" in the swap (payer of the fixed rate)

The seller in the case of the FRA is usually called the "receiver" in the swap (receiving fixed rate)

Single Period Forward Starting Interest Rate Swap

A forward rate agreement is equivalent to a single-period forward-start interest rate swap.

Example

Dave wants to receive £100 in 3 months time.

What will it cost him to today ?

The price of this forward contract would be the present value of £100 in 3 months.

We can use the PV = FV equation to calculate this

Example

Dave wants to invest £90 today and receive £100 in 3 months time.

What fixed interest rate does this forward contract have ?

Present Value / Future Value Calculations

Interest rate forward contracts are just regular loans and deposits at fixed interest rates.

This is type of contract is not considered to be an interest rate derivative.

Changing Floating to Fixed

A contract that will allow you to change a floating interest rate for a fixed interest rate (or vica versa) is an Interest Rate Swap.

What information do you need to price an interest rate forward ?

*) The debt instrument that will be delivered at the future date

*) the maturity date of the debt instrument

*) The Quantity of the debt instrument that will be delivered

*) the settlement date (or delivery date

Hedging Borrowing

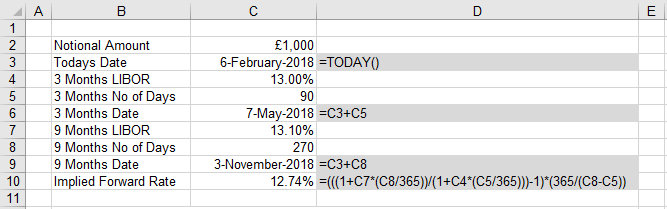

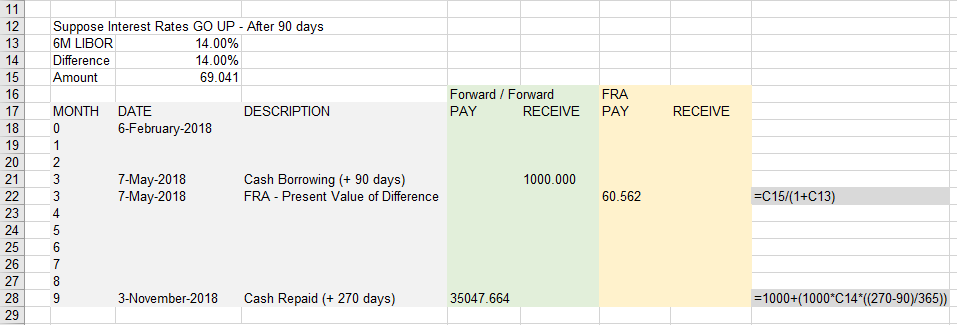

Richard wants to borrow £1,000 for 6 months starting in 3 months time.

The GBP 3 month forward interest is 13.0%.

The GBP 9 month forward interest is 13.1%.

The forward rate would be 12.74%.

How can the bank hedge against the exposure to interest rate risk.

Buying an Forward Rate Agreement

If you are going to borrow cash in the future you can buy an FRA (in advance) to hedge the interest rate risk.

You can then borrow the money at the time you need it.

Buying an FRA and borrowing cash achieves the same net effect as buying a forward-forward which is settled at the start of the loan period

|

|

Hedging Depositing

If you are going to deposit cash in the future you can sell an FRA (in advanced) to hedge the interest rate risk.

You can then deposit the money at the time you want to.

Selling an FRA and depositing cash achieves the same net effect as a forward-forward

Longer 12 Months

Date Conventions

Calendar Spread

© 2026 Better Solutions Limited. All Rights Reserved. © 2026 Better Solutions Limited TopPrevNext