Modified Duration

Also known as MD, Adjusted Duration

measured in percentage terms

The duration is a measure of the sensitivity of the price of the bond to interest rate movements.

It indicates the percentage change in price for a 1% change in interest rates.

This type of duration can be applied to any interest rate sensitive instruments with irregular cash flows.

For fixed coupon paying bonds with continuous compounding the Modified duration and the Macaulay duration are equal

This is the first derivative and measures the rate of change in price with respect to yield.

The price sensitivity and percentage change in price for a unit change in yield in called the modified duration.

Modified duration is the approximate change in a bond's price for a 1% change in its yield to maturity.

Duration, a weighted average measure of the present value of a bond's cash flows, Quantifies how a change in the bond yield affects the bond price.

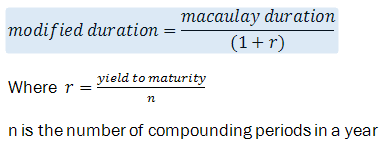

When n is compounded.

This is expressed as a number of years.

This is the price yield relationship

This is a measure of the price sensitivity of a bond to interest rate movements.

It is inversely proportional to the percentage change in price for a given change in yield

Can be thought of as the Macaulay duration adjusted for compounding

|

This can be calculated in Excel using the MDURATION function.

MDURATION (settlement, maturity, coupon, yield, frequency, basis)

The MDURATION function calculates a modified duration given the settlement date, maturity date, coupon rate, yield, frequency, and basis. It uses the following syntax:

For example, suppose you want to calculate the duration of a bond you purchased on April 23, 2000, and that will mature on November 30, 2020. Further suppose that the coupon rate is 8%, which is paid in four quarterly payments, but that the bond yield is 7%. If you want to use the US (NASD) day count basis of 30 days in a month and 360 days in a year, you would use the following formula to calculate this bond's yield:

=MDURATION ("4/23/2000","11/30/2020",.08,.07,4,0)

The formula returns the value 10.4664.

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext