Zero Coupon

Also known as Zeros, Discount Bonds or Deep Discount Bonds.

A zero coupon bond is a bond that pays no periodic interest payments and is bought at price less than its face value.

They are always sold at a discount to its par value as they don't pay any interest.

Investors earn return from the compounded interest all paid at maturity plus the different between the discounted price of the bond and its par value.

Zero coupon bonds do not pay any interest.

All US treasury bills are zero-coupon bonds.

compounded interest ?

Other types are: corporate bonds without coupons

STRIPS - Separate Trading of Registered Interest and Principal of Securities (can be both treasury or corporate)

|

More details Interest Rates > Present Value - Compound Interest

They are issued at a substantial discount from par value..

The bond holder receives the full principal amount on the redemption date.

An example of zero coupon bonds are Series E savings bonds issued by the U.S. government. Zero coupon bonds may be created from fixed rate bonds by a financial institutions separating "stripping off" the coupons from the principal.

In other words, the separated coupons and the final principal payment of the bond are allowed to trade independently. See IO (Interest Only) and PO (Principal Only)

The majority of zero-coupon bonds just pay a fixed amount of money at maturity.

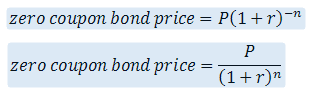

If a bond holder expects to receive $1,000 n years down the road and no interest payments before that date, the only way to obtain a positive return from this bond is to pay less than $1,000 for it today.

The interest earned on a zero-coupon bond is therefore equal to the difference between the discounted price and the redemption payment on maturity

The difference is referred to as the original issue discount (OID)

There is no reinvestment risk.

Inflation Indexed

Some zero-coupon bonds are inflation indexed, so the amount of money that will be paid to the bond holder is calculated to have set amount of purchasing power rather than a set amount of money.

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext