Answers - Price

Price - Q1

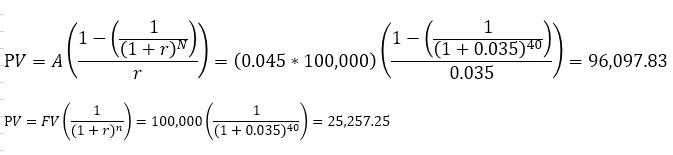

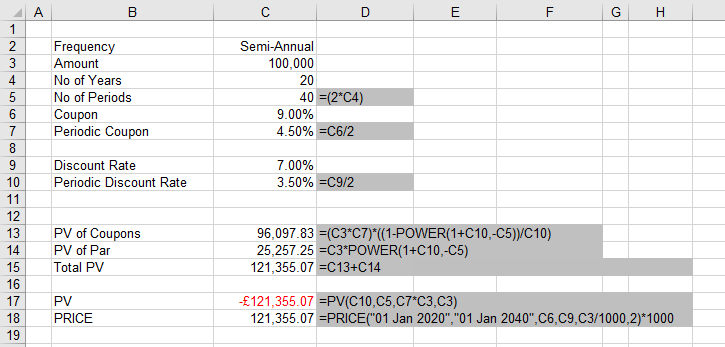

An investor is offered a 9%, 30 year Treasury Bond which is exactly 10 years old at a 7% yield.

What would he pay for $100,000 of this bond ?

He would pay $121,355

Price of the bond would be the present value of the outstanding coupons plus the present value of the face value.

Price - Q2

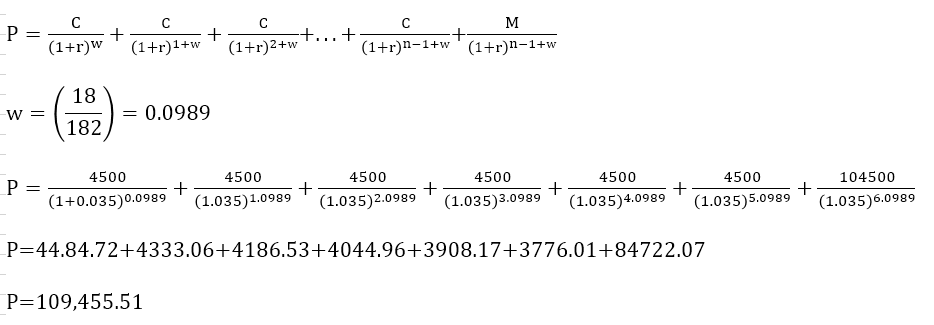

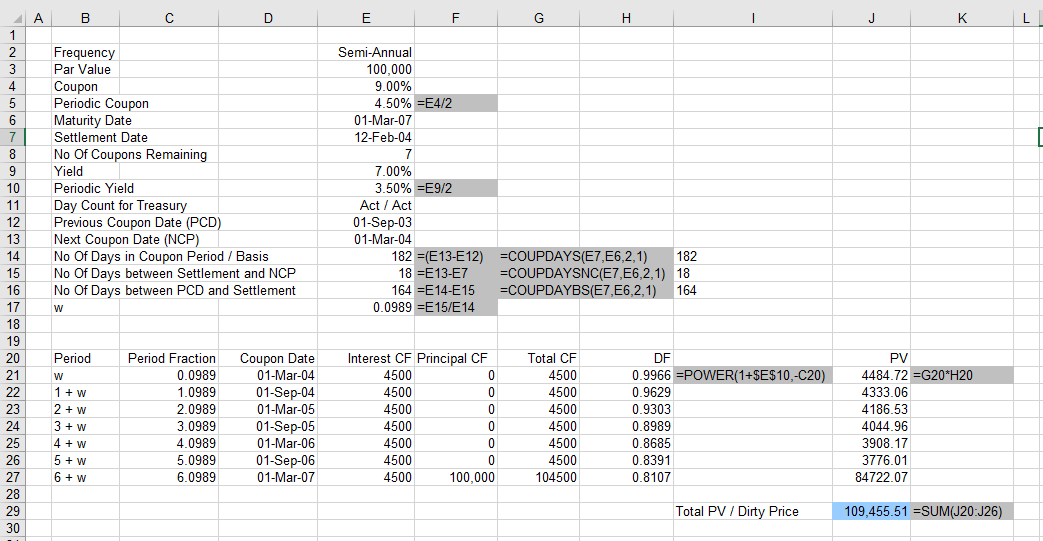

An investor purchases $100,000 of an "off-the-run", 9% 30-year Treasury Bond for settlement on 12 Feb 2020.

The bond is due to mature on 1 March 2023.

What would the dirty price of the bond be if it is priced to yield 7% ?

The dirty price would be $109,455

Calculating the price in between coupon dates

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext