Answers - Yield

Yield - Q1

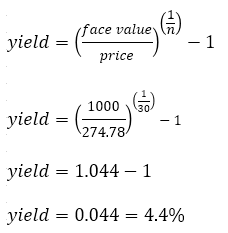

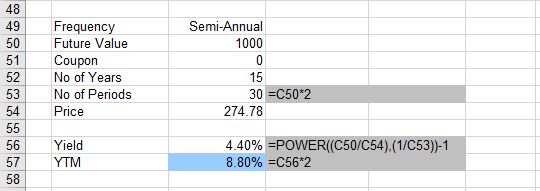

What is the Yield to Maturity for a Zero Coupon Bond selling for £274.78 with a principal of £1,000 maturing in 15 years.

For consistency we must use semi-annual paying.

We must multiple this value by 2.

The yield to maturity is 8.8%.

|

|

Yield - Q2

If you have a semi-annual US Treasury Note with a yield of 4.15% what is this yield annualised ?

annual yield = (1 + 0.0415) [2] - 1

Yield - Q3

If you have an annual paying Corporate Bond with a yield of 9.23% what is the bond equivalent yield ?

BEY = 2 ( ( 1+ 0.0923)[1/2] - 1 )

BEY = 0.090263 = 9.03%

Yield - Q4

If you have a semi-annual paying US Treasury Note with a bond equivalent yield of 9.15% what is the converted to an annual paying yield ?

annual yield = (1 + (0.0915 / 2) )[2] - 1

annual yield = 1.093593 - 1 = 9.36%

Yield - Q5

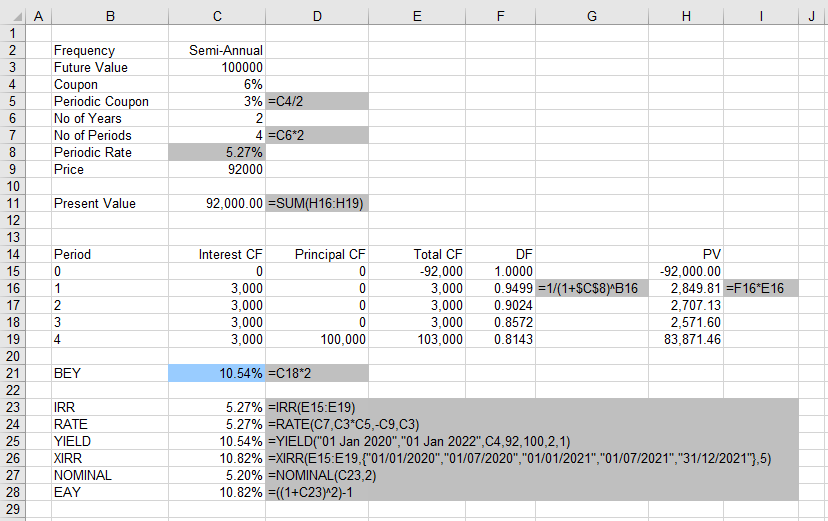

What is the yield of a new $100,000, 6%, 2-year Treasury Note priced at $92,000 ?

Using Excel Goal Seek the periodic yield is 5.27%

The yield is 10.54%

|

Yield - Q6

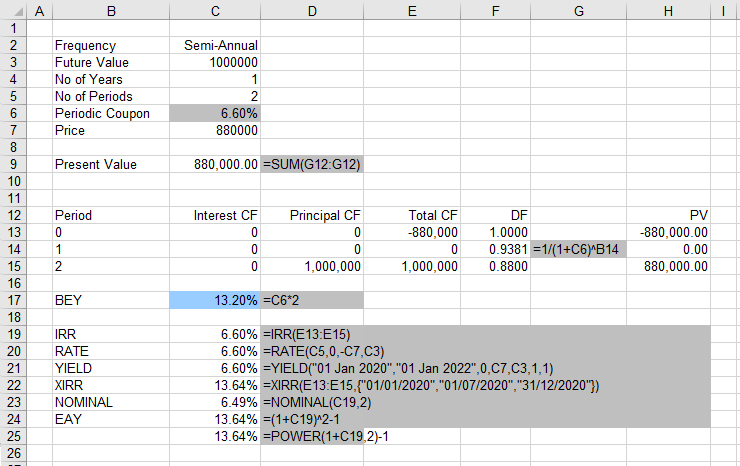

What is the yield of a $1,000,000, 1 year Treasury Bill offered at $880,000 ?

Remember that treasury bills do not have any coupons.

The yield is 13.20%

|

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext