Price On A Coupon Date

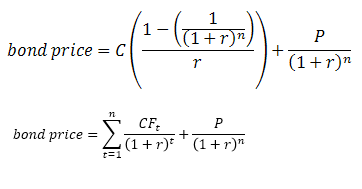

A sequence of equal cash flows at regular intervals is called an Annuity

The coupon payments on a bond are an example of an annuity.

You can calculate the price of a bond on a coupon date by:

1) Using the PV function.

2) Using any of the functions or methods for Between Coupon Dates.

Annual Coupons

Compounded annually.

|

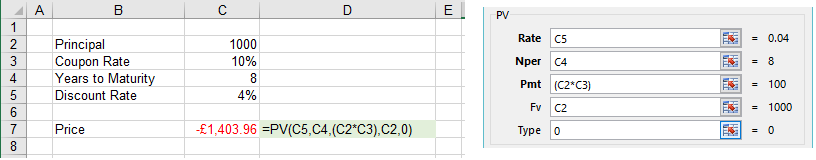

What is the price of an 8 year bond with a par value of $1,000 and a 10% coupon paid annually?

Lets assume that the interest rate (or discount rate) is 4%.

The price of a bond on a coupon date can be calculated in Excel using the PV function.

|

This bond is selling at a premium because the interest rate is less than the coupon rate.

Semi-Annual Coupons

Compounded semi-annually.

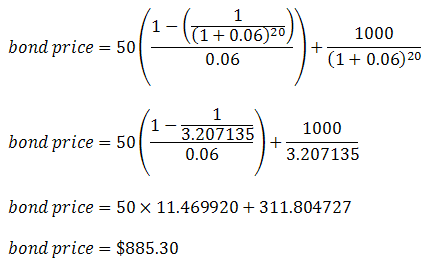

What is the price of an 10 year bond with a par value of $1,000 and a 10% coupon paid semi-annually?

Lets assume that the interest rate (or discount rate) is 12%.

1) Calculate the number of coupon payments - The coupon is paid semi-annually so there will be 2 coupon payments a year, making 20 coupon payments in total

2) Calculate the value of each coupon payment. The coupon rate will be 10/2 = 5% of the bond par value, so (1000 * 0.05) = $50.

3) Calculate the semi annual interest rate. The semi-annual interest rate will be 12/2 = 6%.

|

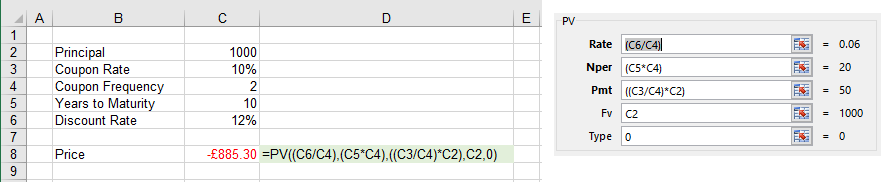

The price of a bond on a coupon date can be calculated in Excel by using the PV function.

|

This bond is selling at a discount because the interest rate is greater than the coupon rate.

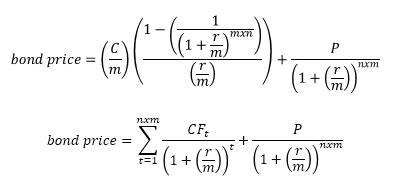

M Coupons A Year

where m represents the frequency of the coupon payments.

where C is the annual coupon amount

If quarterly then m=4. If monthly then m=12

|

© 2026 Better Solutions Limited. All Rights Reserved. © 2026 Better Solutions Limited TopPrevNext