using Spot Rates

Using the Spot Curve

Continuously Compounding

assumption: compounded continuously

Using zero-coupon rates is the only true interest rate for any term to maturity.

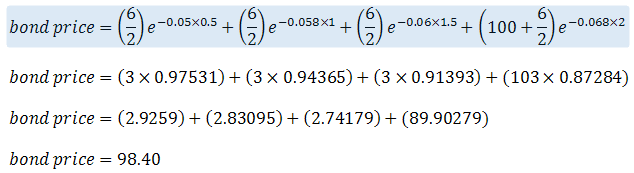

Example - Bond pricing using spot rates

Lets assume that we have the following treasury zero rates:

6 month treasury rate - 5%

12 month treasury rate - 5.8%

18 month treasury rate - 6.4%

24 month treasury rate - 6.8%

The price of the bond is the present value of all the future cash flows

The present value can be calculated using the appropriate zero rates as discount rates.

|

The more accurate approach might be the used to price interest rate swaps to calculate the present value of the future cash flows using discount rates that are determined by the markets view of where interest rates will be in the future.

These expected rates are known as "forward rates".

These are however "implied"

A YTM calculation based on forward rates is also speculative

© 2026 Better Solutions Limited. All Rights Reserved. © 2026 Better Solutions Limited TopPrevNext