Vanilla Swap

This is a Fixed / Floating Same Currency swap

This is used to hedge interest rate risk.

This swap exchanges Interest Only (no principal)

One counterparty agrees to pay either fixed or floating on a notional amount

These are the most common and the most liquid type of interest rate swap.

These are traded in the Over The Counter market (not on exchanges)

These instruments let companies manage their floating rate debt liabilities by allowing them to pay fixed rates and receive floating rate payments.

This is the most common type of swap

The interest is calculated on an amount called the Notional Principle.

Fixed Rate Payer

Fixed Rate Receiver

The firm paying the fixed rate (or "fixed leg") is called the buyer and is said to be "long the swap."

That paying the floating rate is called the seller and is "short the swap," though these terms are really just a market convention

how much does the person paying fixed:

It's the sum of the difference between the fixed swap rate and the forward rate, discounted at the risk-free rate for each of the accrual periods between present and maturity multiplied by the notional amount.

think of this is that two bonds are being swapped - a fixed bond for a floating bond, and the principal amounts cancel out.)

Swap Rate

The Fixed Interest Rate in this exchange is called the Swap Rate

The swap rate is chosen so the present value of the swap is zero (ie the discounted value of the floating rate payment equals the discounted value of the fixed rate payment)

As the forward expectation of LIBOR change, so will the swap rate (or fixed rate)

Example

While the floating leg could be any money market instrument, the most common instrument is LIBOR.

We want to swap our fixed rate for the floating LIBOR rate.

The convention for quoting these types of swaps is that the dealer sets the floating rate equal to LIBOR and then quotes the swap rate that will apply.

Always quoted fixed vs floating

30/360 or Act/360

You will need at least one Forward Curve (for example 3M LIBOR) for cash flow generation.

as well as a Discount Curve for calculating present values

Both cash flows are in the same currency

The fixed payer is the long party

The fixed receiver is the short party

The value at the outset is zero because the fixed rate of the swap should have been the same present value as the floating side.

Whenever there is a payment date the amount transferred is the "net" amount

One party agrees to pay the fixed interest rate cash flow on a notional amount and receive the floating rate cash flow on the same notional over a fixed period of time.

The floating rate used in a lot of currency swaps is LIBOR.

Same Currency

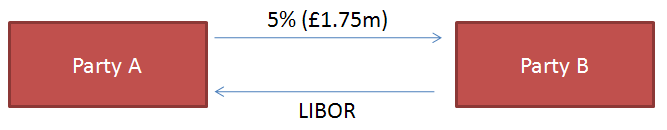

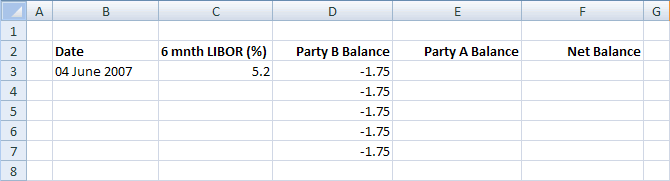

Lets imagine a 3 year vanilla swap initiated on the 4th June 2007 between two parties on a notional amount of £50 million.

Party A agrees to pay a fixed interest rate of 5% per annum.

Party B agrees to pay a floating interest rate of six month LIBOR

The agreement is to exchange cash flows every 6 months.

|

The first cash flow exchange will be made in 6 months using the current six month LIBOR rate.

|

5% interest for 6 months on £50m is £1.75m

5.2% interest for 6 months on £50m is ??

Swap Spread

The difference between a yield curve and the swap curve is called the swap spread.

The fixed rate is some spread above the Treasury yield curve with the same term to maturity as the swap and is called the Swap Spread.

Muni Basis Swaps

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext