Nominal Interest

Known as Annual Percentage Rate (APR) in both the US and UK.

Also referred to as Stated Interest Rate or Quoted Interest Rate.

A nominal interest rate is an interest rate that has a compounding frequency of less than a year.

A nominal interest rate is quoted as a percentage WITH a compounding frequency.

The compounding frequency indicates the number of compounding periods in a year.

Excel Worksheet Function

NOMINAL - This function returns the nominal interest rate over a period given an effective (or annual) interest rate.

|

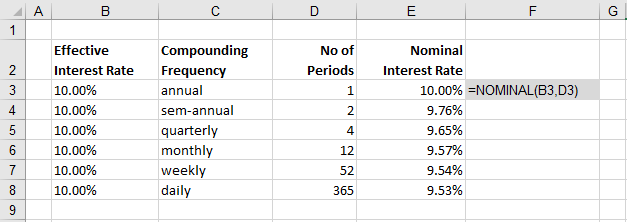

This table shows the nominal interest rates for 10% with different compounding frequencies.

The nominal interest rate is lower.

|

Misleading and Confusing

When banks charge interest they often quote using a nominal interest rate, because this is lower than the 'actual' interest rate.

When banks pay interest they often quote using an effective interest rate, because this looks higher.

Comparing Nominal Interest Rates

When the compounding frequency is a year the nominal interest rate and the effective interest rate are the same.

Nominal interest rates are not comparable unless their compounding frequencies are the same.

The interest rate that your bank quotes you on a credit card is a nominal interest rate (that is compounded daily).

The interest rate that you will actually pay though, is higher. You will pay the effective interest rate.

Your bank might offer you a credit card that charges 9.53% APR, this is actually an annual interest rate of 10%.

If your bank offers you a credit card that charges 25% APR, this is actually an annual interest rate of 28.4% (=EFFECT(25%, 365)).

© 2026 Better Solutions Limited. All Rights Reserved. © 2026 Better Solutions Limited TopPrevNext