Answers - Present Value

Present Value - Q1

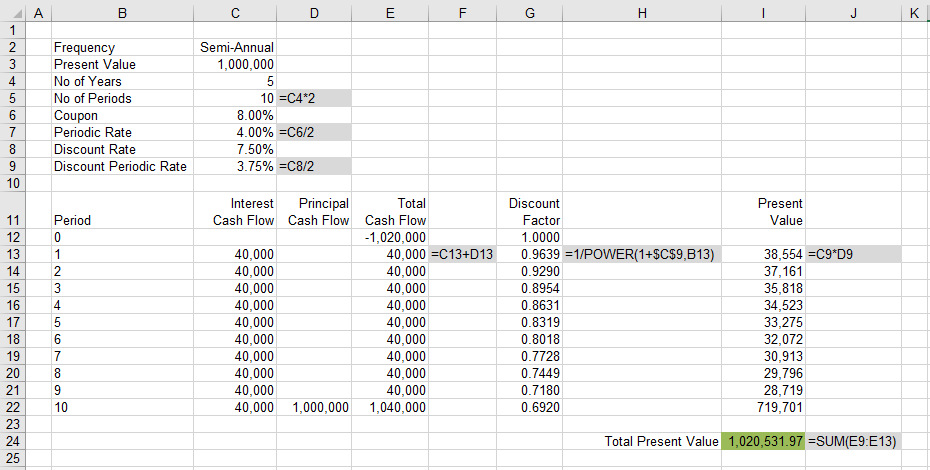

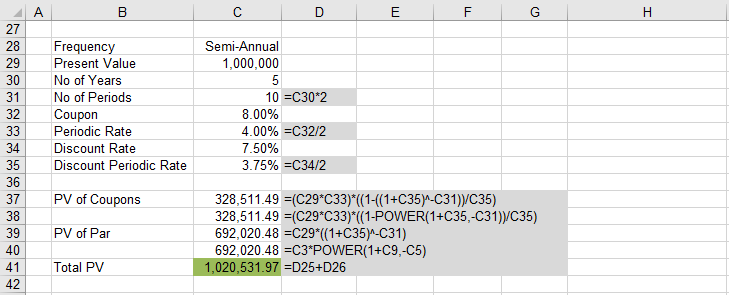

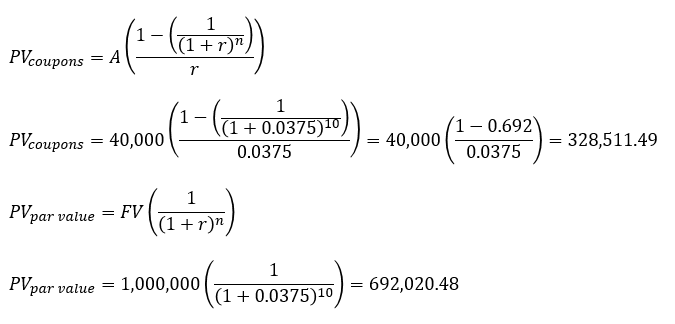

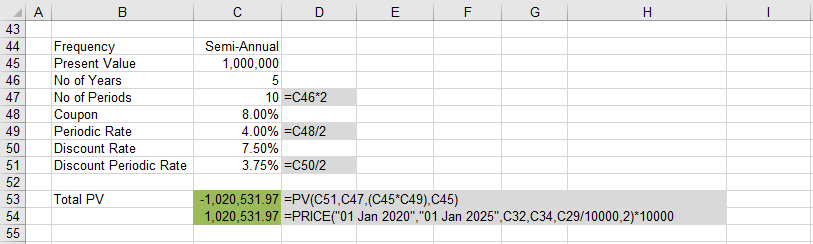

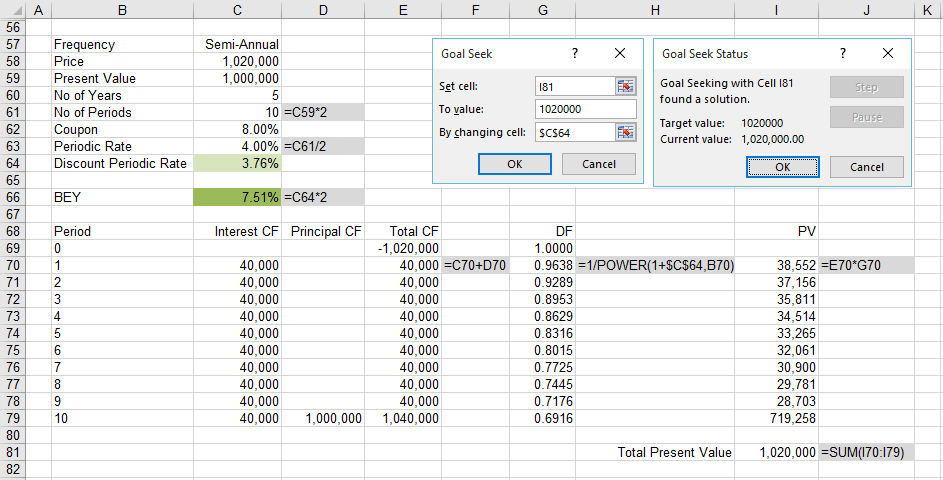

A fund manager is looking for a return of 7.5% a year.

He sees a 5 year treasury bond paying 8% with a face value of $1,000,000 selling at $1,020,000.

Should he buy this bond?

The fund manager should buy this bond because it has a present value of $1,020,531.97.

|

|

|

|

An alternative to calculating the present value you could calculate the yield that the bond is offering.

The fund manager should buy this bond because it has a yield (Bond Equivalent Yield) of more than 7.5%.

|

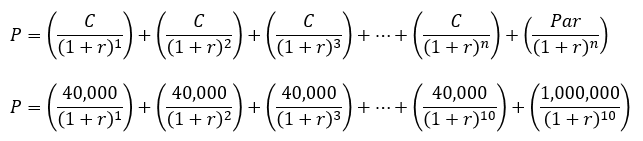

The Goal Seek is finding a solution to the following equation, solving for 'r'.

|

Present Value - Q2

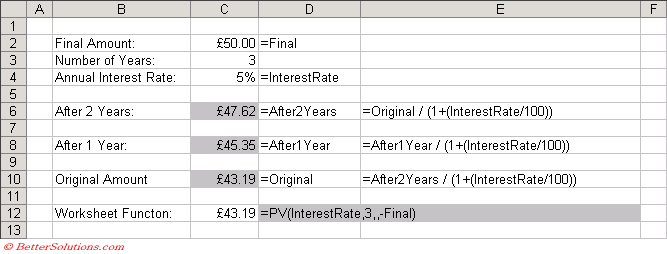

If a bank offers a componded interest rate of 5% how much money do I need to invest in order to have $50 after 3 years.

The amount you need to invest at the beginning of the 3 years is £43.19.

|

The present value can be calculated with the following equation:

|

© 2025 Better Solutions Limited. All Rights Reserved. © 2025 Better Solutions Limited TopPrevNext